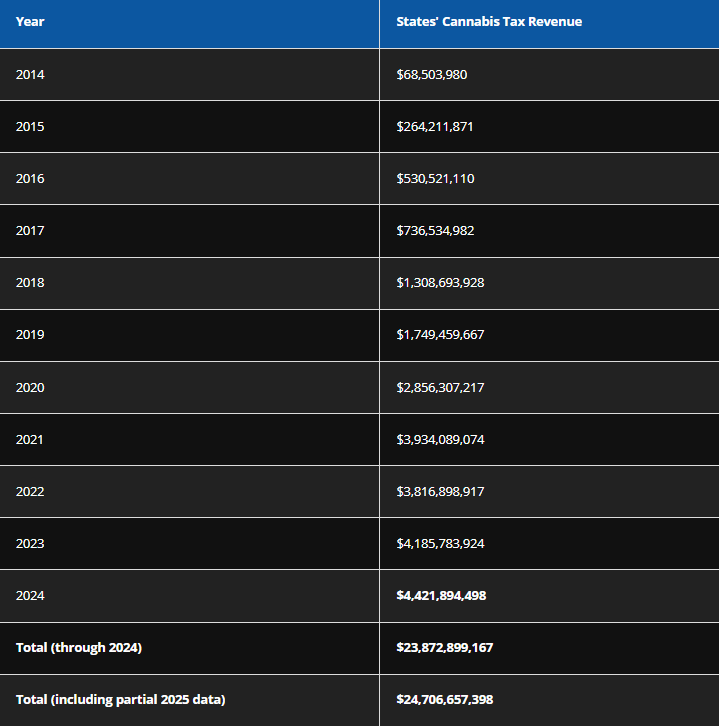

Since Colorado and Washington launched the first legal marijuana markets in 2014, states have collectively generated over $24.7 billion in tax revenue from recreational sales, according to a new report by the Marijuana Policy Project. The total surpassed $4.4 billion in 2024 alone — a record high for a single year.

Recreational marijuana is now legal in 24 states, with sales currently active in 21 of them. Among these, seven states brought in more than $200 million in 2024, including California, Washington, and Michigan. Four states exceeded the half-billion mark, with California leading the nation with over $1 billion in annual marijuana tax revenue for the fifth consecutive year.

Since the start of legalization, states have directed these revenues toward a wide range of programs and services, including public education, infrastructure, public health, addiction treatment, housing initiatives, and community reinvestment for areas harmed by past marijuana enforcement. In some states, these funds have outpaced alcohol taxes and made up as much as 1.5% of the entire state budget.

Here’s a look at the latest figures from several of the top-grossing marijuana states:

California has brought in more than $6.7 billion in marijuana tax revenue since legal sales began in 2018. The state saw $1.01 billion in 2024 alone. Revenue supports environmental programs, childcare services, and grants for communities disproportionately impacted by the war on drugs.

Washington has generated over $4.7 billion since 2014. The state collected more than $516 million in 2024, despite eliminating the excise tax for medical marijuana patients midyear. More than half of Washington’s marijuana revenue goes toward healthcare for low-income children.

Colorado, which kicked off adult-use sales on January 1, 2014, has generated over $2.6 billion in state revenue. In 2024, the state collected roughly $237 million. More than a third of Colorado’s total marijuana revenue has gone to support public education.

Michigan has collected over $1.7 billion in marijuana tax revenue since adult-use sales began in late 2019. The state took in more than $523 million in 2024, with funds allocated to schools, roads, and local governments based on the number of marijuana retailers in each area.

Illinois surpassed $2 billion in marijuana revenue in 2024, just four years after launching its legal market. That year alone, the state generated over $577 million. Illinois earmarks 25% of its marijuana tax revenue to fund grants for communities harmed by drug criminalization.

Massachusetts crossed the $1 billion threshold in 2024. That year, the state collected over $282 million in adult-use marijuana taxes. Local governments also gained an additional $38 million through optional local taxes.

Oregon reached $1.1 billion in marijuana revenue in 2024, with most recent revenue going to a fund created by the state’s drug decriminalization law. The state took in $153 million last year.

Arizona generated over $253 million in adult-use marijuana tax revenue in 2024, bringing its total to nearly $889 million since launching sales in 2021. A large portion of revenue goes to community colleges, transportation, and first responders.

New York, despite a slow rollout and challenges with unlicensed sellers, brought in around $135 million in 2024, more than six times its 2023 total. New rules enacted last year replaced a potency-based tax with a wholesale excise tax to simplify the system.

Missouri, which legalized in late 2022 and launched sales in early 2023, has already generated over $236 million in tax revenue from recreational marijuana. In 2024 alone, the state brought in more than $130 million, with funds split among veteran services, drug treatment, and public defense.

New Mexico, where legal sales began in April 2022, saw $76 million in revenue in 2024, pushing its total to over $180 million. Much of the tax revenue is sent directly to the municipalities where sales occur.

Ohio, the newest state to launch legal recreational sales, generated $16 million in marijuana tax revenue in the final five months of 2024. That number doubled in the first few months of 2025, showing early momentum in the state’s rollout.

As marijuana legalization continues to expand, its economic impact remains significant. In 2024, the $4.42 billion collected nationwide was enough to fund Medicaid coverage for more than half a million Americans. With public support for legalization now reaching 68%, up from 34% in 2003, more states are likely to consider similar reforms — not just for the revenue, but for the broader societal benefits tied to regulation, public safety, and social equity.