Since the opening of the first recreational marijuana store in January 2018, California has collected an impressive $6 billion in tax revenue.

According to data from the research firm Headset and the California Department of Tax and Fee Administration, licensed marijuana stores recorded over $27 billion in “taxable sales” from 2018 through July of this year. “Taxable sales” encompass both marijuana and marijuana products, as well as related paraphernalia like pipes and rolling papers.

In California, a 15% tax is levied on marijuana sales, in addition to the state’s standard 7.25% sales tax.

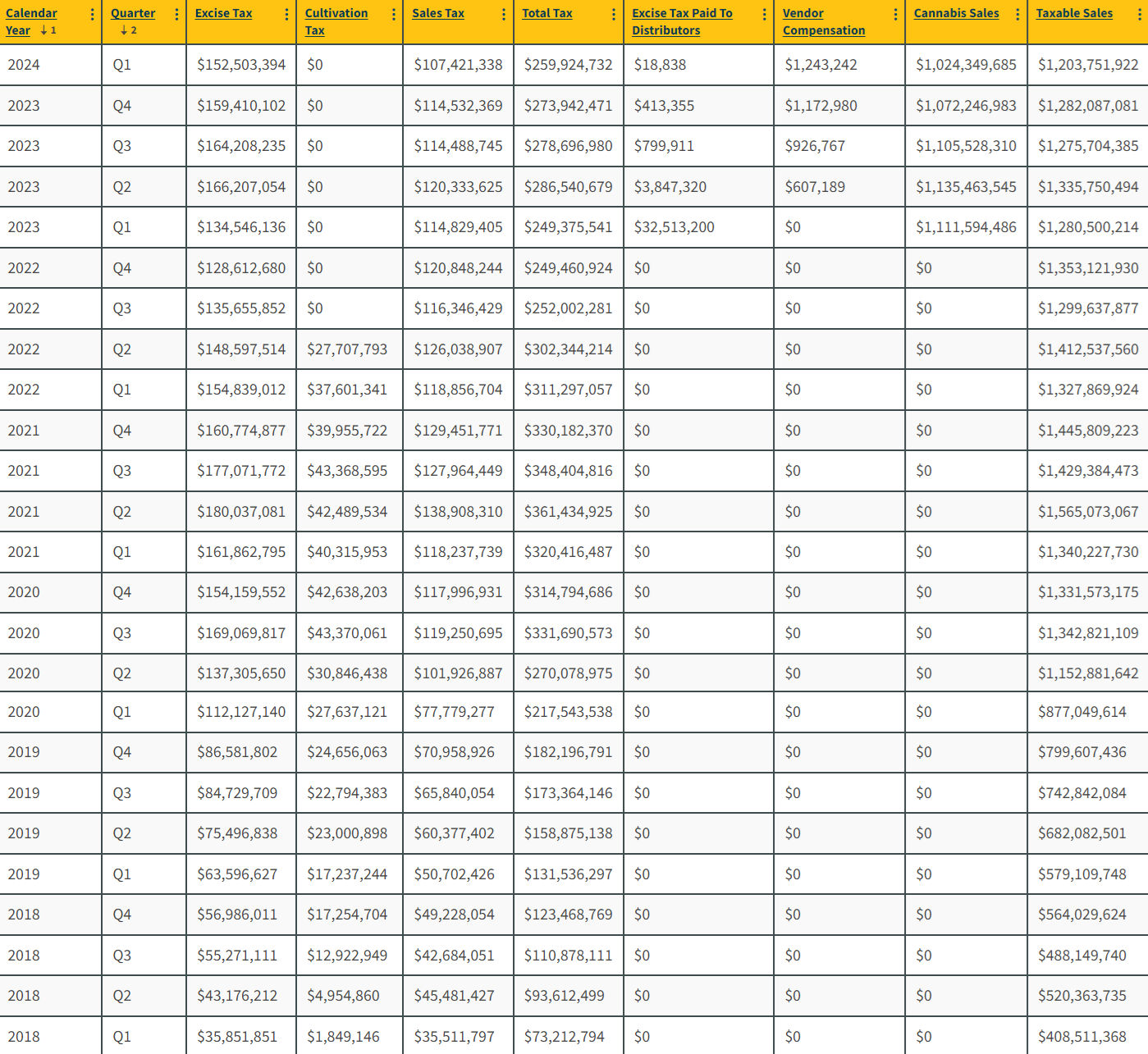

Below is an annual breakdown of marijuana tax revenues since the inception of legal sales:

- 2018: Taxable Sales: $1,981,054,467; Total Tax Revenue: $401,172,173

- 2019: Taxable Sales: $2,803,641,769; Total Tax Revenue: $645,972,372

- 2020: Taxable Sales: $ 4,704,325,540; Total Tax Revenue: $1,134,107,772

- 2021: Taxable Sales: $ 5,780,494,493; Total Tax Revenue: $1,360,438,598

- 2022: Taxable Sales: $5,393,167,291; Total Tax Revenue: $1,115,104,476

- 2023: Taxable Sales: $5,174,042,174; Total Tax Revenue: $1,088,555,671

- 2024 (Q1): Taxable Sales: 1,203,751,922; Total Tax Revenue: 259,924,732

- 2024 (July): Taxable Sales: $350 million (estimated); Total Tax Revenue: $70 million (estimated)

Cumulative Totals:

- Total Taxable Sales: $27.4 billion

- Total Tax Revenue: Approximately $6 billion

Q2, 2021 was the top quarter for taxable sales at $1.56 billion, garnering $361 million in tax revenue.

California legalized marijuana in 2016, following Colorado and Washington, which were the first states to do so in 2012. The law allows those 21 and older to purchase, possess, and use of up to one ounce of marijuana and up to eight grams of marijuana concentrates. It also allows for personal cultivation of up to six marijuana plants.

California’s marijuana tax revenue is primarily allocated to three areas: 60% supports youth programs focused on substance abuse prevention and education, 20% funds environmental initiatives to repair damage from illegal cultivation, and the remaining 20% goes to public safety, including grants for law enforcement and health services.

(Photo credit: California Department of Tax and Fee Administration).