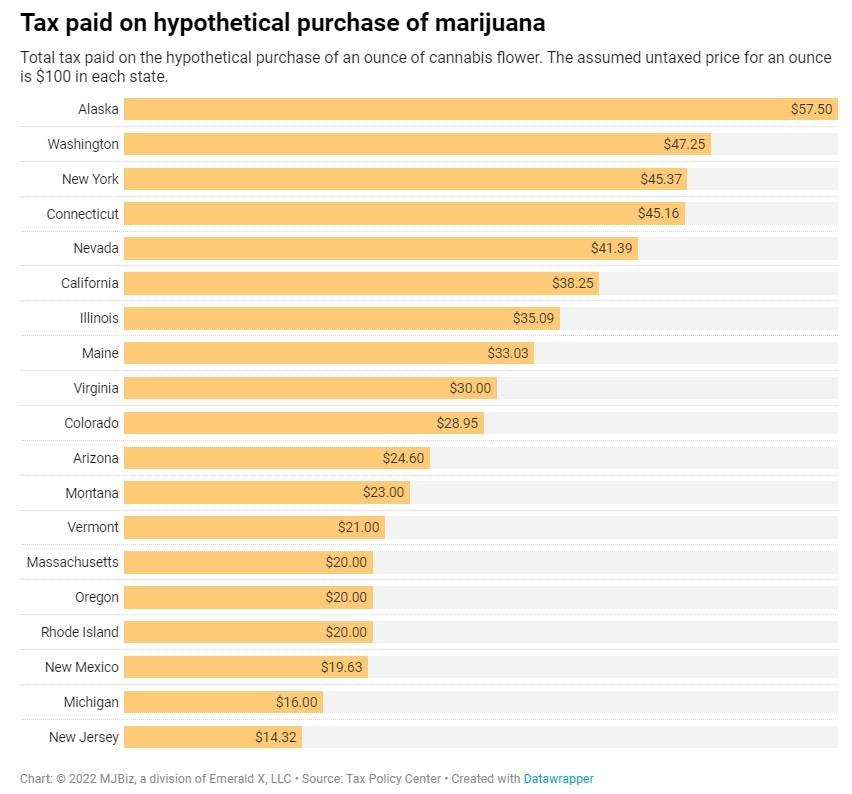

According to a new report by the Urban Institute and Brookings Institution’s Tax Policy Center, Alaska has the highest marijuana tax rate of all states that have legalized the plant.

The report found that for every $100 ounce of marijuana purchased, Alaskans pay $57.50 in marijuana taxes, making it the highest tax rate in the country. The next closest state is Washington, with $47.25 in marijuana taxes paid on every $100 ounce.

The report found that for every $100 ounce of marijuana purchased, Alaskans pay $57.50 in marijuana taxes, making it the highest tax rate in the country. The next closest state is Washington, with $47.25 in marijuana taxes paid on every $100 ounce.

On the other end of the spectrum, New Jersey was found to have the lowest tax rate, with $14.32 in taxes paid on every $100 ounce, which is drastically lower than the $57.50 paid by Alaskans. The second lowest is Michigan at $16.

For the report, researchers compared the taxes on a retail purchase of 1 ounce of cannabis flower in the 19 states where recreational marijuana was legal by September 2022.

Below is a chart detailing the tax rate for each legal marijuana state.

Below are more highlights from the report and its authors, courtesy of MJBizDaily:

- 2022 was the first fiscal year in which any state cannabis tax revenue declined from the previous year: California, Colorado, Nevada, Oregon and Washington – the more mature legal markets – all saw declines, while Alaska stayed flat.

- For fiscal year 2022, California collected the most state cannabis tax revenue at $744.4 million, or $20 per capita. Cannabis taxes accounted for 0.3% of total state tax revenue (excluding local taxes).

- Washington state and Colorado had the highest per capita taxes for fiscal year 2022, at $67 and $61, respectively.

- Maine had the lowest per capita total for state cannabis taxes, at just $13 per capita.

- The most popular approach to taxation of marijuana is through a retail tax, which is more streamlined from an administrative perspective. Wholesalers don’t have to pay it out, for example.

- The authors didn’t investigate a relationship between high taxes and illicit markets while cautioning that other factors are related to how a legal market is operating, such as how many and where legal stores are.

- Local taxes are among the most burdensome on consumers and have been blamed for some of the challenges facing the industry in California, for example. But they are often necessary for municipal governments to buy into allowing cannabis businesses to open.

- Potency-based taxes are designed to disincentivize consumers from buying higher-potency products, but they could also incentivize consumers to buy potent products from the illicit market.

- Connecticut and New York’s forthcoming adult-use cannabis markets will be the first to levy a tax calculated per milligram of THC. Illinois also taxes cannabis based on potency, but that state assigns a higher sales-tax percentage to more potent products.