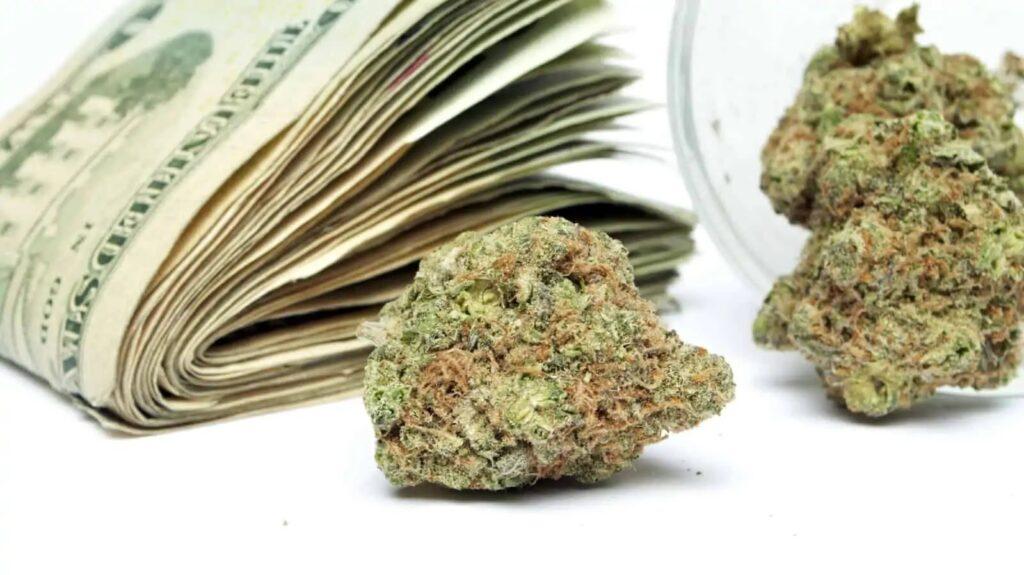

Members of the US House of Representatives have introduced the Small Business Tax Equity Act, meant to level the playing field for legal cannabis businesses by normalizing their federal taxes.

The Small Business Tax Equity Act provides an exemption for state-licensed cannabis businesses from federal tax code 280E. That particular code explicitly prevents anyone involved in the distribution of a federally prohibited substances from deducting business expenses, even if the substance they sell is legal under state law. The bill was filed by Representatives Earl Blumenauer (D-OR), David Joyce (R-OH), Barbara Lee (D-CA), and Nancy Mace (R-SC).

“NORML commends the sponsors of this legislation for their efforts to end the unjust federal overtaxation of licensed, state-regulated cannabis businesses throughout the country,” said NORML Political Director Morgan Fox. “Allowing them to take the same federal tax deductions that most other businesses enjoy will facilitate new opportunities in the legal cannabis industry and make it more competitive with the unregulated market, which will directly benefit consumer health and public safety.”

As noted by Fox, the 280E tax code was originally intended to target the profits of illegal drug traffickers, similar to how federal authorities combatted organized crime syndicates during alcohol prohibition. The inability of state-legal cannabis companies to deduct normal business expenses exacerbates the outsized financial burdens facing the regulated industry and disproportionately impacts smaller and underfunded operators. This barrier to entry and long term success makes it increasingly difficult for licensed cannabis businesses to compete with the unregulated market, in which unlicensed operators generally do not pay federal taxes.

“State-legal cannabis businesses are denied equal treatment under 280E. They cannot fully deduct the cost of doing business which means they pay two or three times as much as a similar non-cannabis business,” said Congressman Blumenauer. “This grotesquely unfair treatment incentivizes people to cut corners. If Congress wants to get serious about supporting small businesses and ending the illicit cannabis market, it is common sense that we allow legal cannabis operations to deduct business expenses, just like any other industry.”

This legislation was introduced in previous sessions of Congress but did not advance during those sessions. In recent years, lawmakers in several states with legal cannabis markets have moved to increase the deductions which cannabis businesses can claim on their state taxes.

It is estimated that roughly $30 billion in legal cannabis sales took place in 2022. Regulated cannabis businesses employ nearly 430,000 people in the U.S., according to a Leafly report released last year.