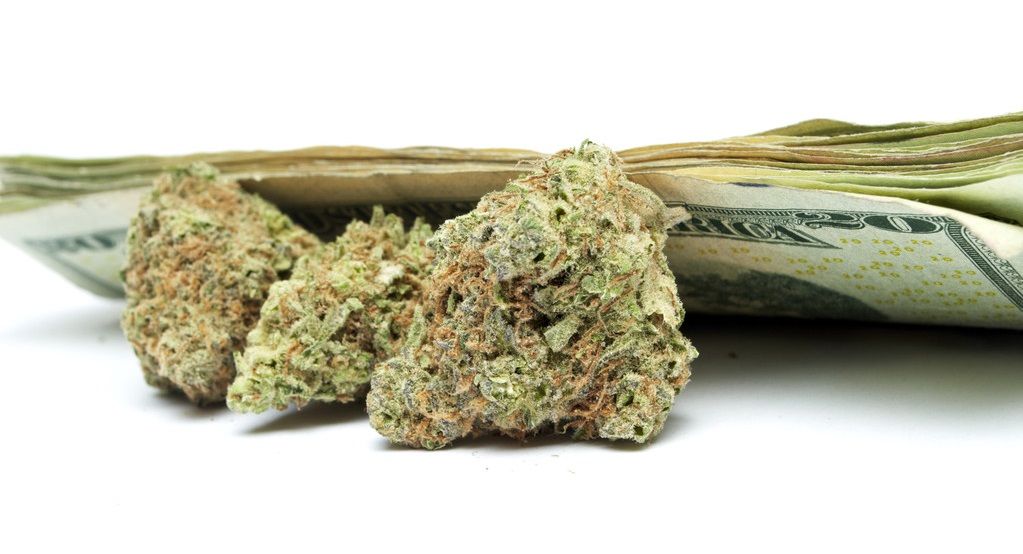

Since the start of legal recreational marijuana sales in Oregon, the state has garnered well over $1 billion in tax revenue, with localities garnering an additional over $150 million.

Oregon was the third state to legalize recreational marijuana in 2014, following Colorado and Washington’s lead in 2012. Due to bureaucratic delays, the first licensed marijuana store didn’t open until October, 2016.

Oregon was the third state to legalize recreational marijuana in 2014, following Colorado and Washington’s lead in 2012. Due to bureaucratic delays, the first licensed marijuana store didn’t open until October, 2016.

The law allows those 21 and over to possess up to two ounces of marijuana in public and eight ounces at home, in addition to up to one ounce of marijuana extracts, 16 ounces of marijuana-infused solids, and 72 ounces of marijuana-infused liquids are allowed. Licensed retailers are authorized to sell marijuana and marijuana products.

Since the start of legal marijuana sales in October 2016, total marijuana sales in the state have reached $6.8 billion, according to the Oregon Liquor and Cannabis Commission. This has resulted in approximately $1.15 billion in tax revenue, based on the state’s 17% marijuana tax rate. In addition to this, localities —which have the option of placing a citywide tax of up to 3%— have garnered an additional $156 million. The combined total is approximately $1.3 billion.

The taxes generated from marijuana sales is distributed to various state funds: 40% goes to the State School Fund, 20% to mental health and treatment services, 15% to the State Police, 20% to local law enforcement, and 5% to the Oregon Health Authority for drug treatment and prevention programs.

As of the end of July, the average price per gram of dried marijuana flower was $3.78 per gram, while the average price of concentrates was $16.33 per gram.