Colorado garnered over $20 million in marijuana taxes in January.

According to data released today by the Colorado Department of Revenue, the state brought in exactly $20,474,865 in tax revenue from the roughly $110 million in licensed marijuana sales in January. This brings the all-time tax revenue for the state to $2,893,997,549.

The $20.4 million in marijuana taxes made in January is an increase from the $19 million brought in in December, but a slight decrease from the $21 million garnered in January 2024.

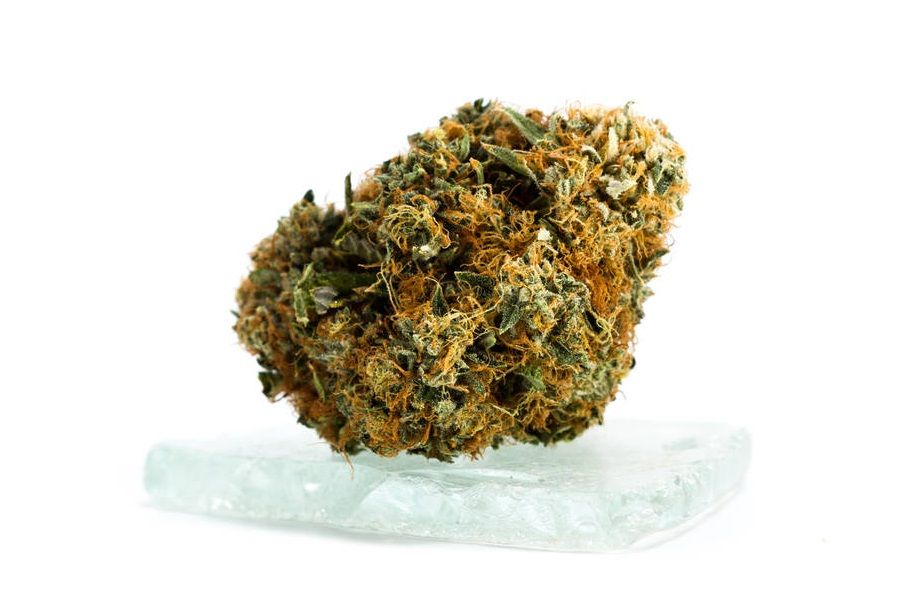

Colorado legalized marijuana in 2012, tying Washington as the first state to do so. The law allows those 21 and older to legally possess up to one ounce of dried marijuana, up to eight grams of marijuana concentrates such as wax, live resin, and shatter, and edibles with a maximum of 800 milligrams of THC. These items can be purchased from a licensed marijuana retail outlet or dispensary. The first licensed retail outlet opened in 2014.

Colorado imposes a 15% retail sales tax on recreational marijuana and a 15% excise tax on the initial transfer of marijuana from a wholesaler to a retailer. Medical marijuana is only subject to the statewide sales tax of 2.9%. Additional local taxes of up to 2.9% may also be applied to retail sales.