In March, Arizona collected over $24 million in tax revenue from legal marijuana sales.

Arizona collected a total of $24,308,528 in marijuana taxes in March. This figure slightly exceeds the $23.4 million collected in March 2023 and the $22.4 million in March 2022, illustrating a consistent upward trend in revenue from the state’s marijuana sales. These March collections add to the overall tax revenue, which has reached $830,733,898 since the inception of legal recreational cannabis sales in February 2021.

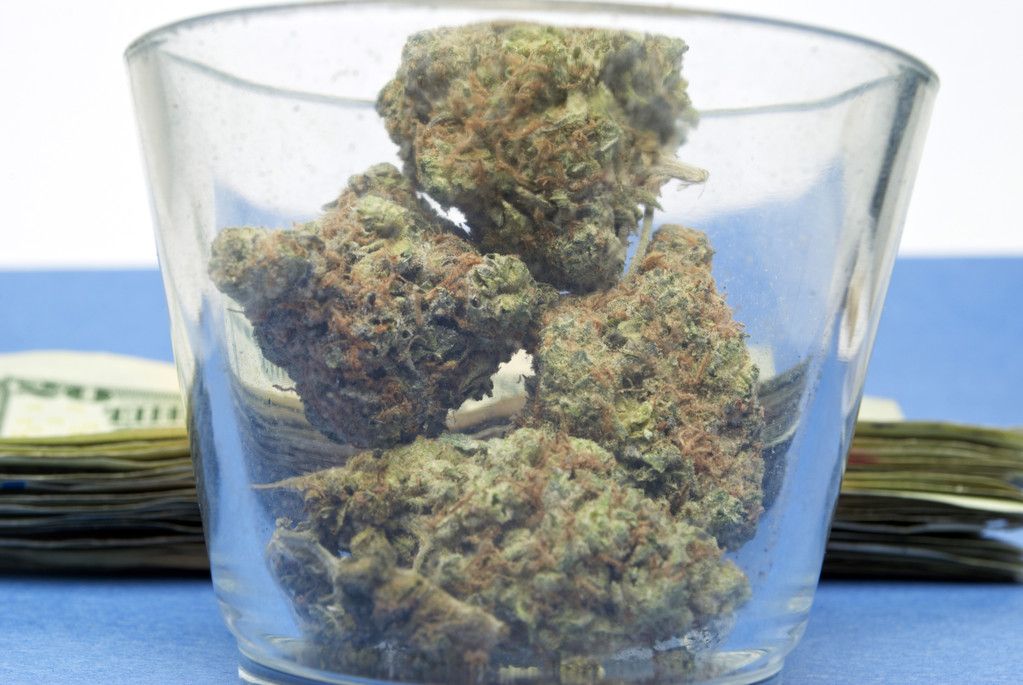

Although monthly marijuana tax revenue in Arizona has exceeded $25 million on four occasions, the revenue for March remains noteworthy due to its steady growth year-over-year. The tax revenue is derived from the sale of various cannabis products including dried marijuana flower, prerolls, concentrates, edibles, tinctures, and topicals.

Year-to-date, the total marijuana tax revenue for 2024 is $73.2 million, putting the state on track for nearly $300 million for the year. The record for the highest amount of marijuana taxes collected in a single month still stands at $28,423,424, achieved in May, 2023.

In Arizona, marijuana was legalized in 2020 through a citizen’s initiative. The law permits individuals aged 21 and older to purchase and possess up to an ounce of marijuana and up to five grams of marijuana concentrates. The state imposes a transaction privilege tax of 5.6% on both medical and recreational marijuana, with an additional excise tax of 16% on recreational sales.

For more detailed information on marijuana sales and tax revenue, the Arizona Department of Revenue provides updates and data on its website.