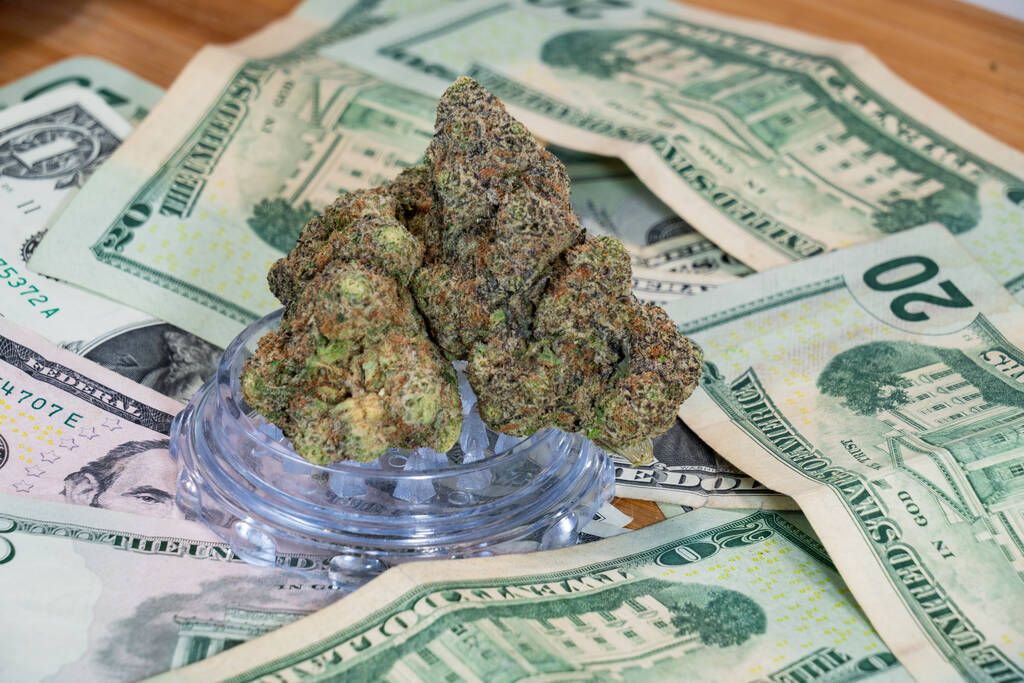

Colorado’s tax revenue from legal marijuana sales has exceeded $150 million in the first seven months of the year.

According to the Colorado Department of Revenue, the state has collected $150,904,366 in tax revenue from legal marijuana sales so far in 2024. This brings the cumulative total to $2,769,062,068.

The $150 million in taxes was generated from approximately $770 million in marijuana sales, including $100 million in July alone. All-time sales have now exceeded $16 billion.

April was the biggest month for marijuana tax revenue this year, with $23.3 million collected. The all-time record for monthly tax revenue remains $40 million, set in August 2020 during the height of the pandemic.

Colorado legalized recreational marijuana in 2012, becoming the first state to do so alongside Washington. The law allows those 21 and older to legally possess and cultivate marijuana for personal use. Licensed retail outlets began selling marijuana in 2014. Retail marijuana is subject to a 15% sales tax on retail sales and a 15% excise tax on the first transfer of marijuana from a wholesaler to a processor or retailer, in addition to the state’s 2.9% sales tax and a local tax of up to 2.9%. Medical marijuana is exempt from the 15% sales tax and 15% excise tax but is still subject to the 2.9% statewide sales tax.

A statewide survey of registered Colorado voters conducted by Public Policy Polling found that 71% of voters believe marijuana should be legal for adults, similar to alcohol, while fewer than one in four (23%) think it should be illegal. Support for legalization has grown by 16% since it was passed by voters in 2012.