Illinois’ legal marijuana market remained steady in September, with licensed retail outlets and dispensaries selling $167.9 million worth of product, according to data from the Illinois Cannabis Regulation Oversight Officer.

Approximately 85% of these sales were made by recreational consumers, while medical marijuana purchases accounted for 15% of the total. Nearly one in four recreational marijuana purchases was made by non-residents, with Illinois residents responsible for around 77% of the sales.

Year-to-date, marijuana sales in Illinois have surpassed $1.5 billion, generating over $275 million in tax revenue.

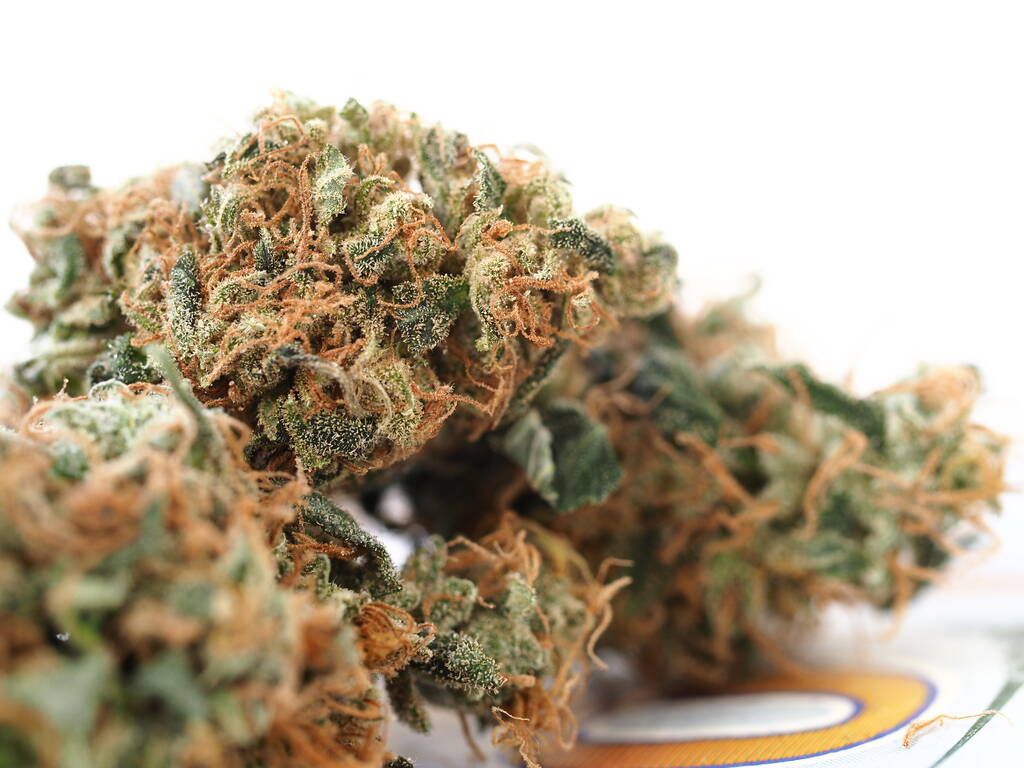

The average price per gram of dried marijuana remained steady at around $9 per gram.

Illinois legalized marijuana in 2019. The law allows those aged 21 and older to purchase up to 30 grams of dried marijuana, 5 grams of marijuana concentrates, and up to 500 milligrams of THC in marijuana-infused products if they reside in the state. Non-residents are allowed to possess half these amounts.

The tax rate for marijuana ranges from 10% to 25% depending on the product. This is in addition to the state’s 6.25% sales tax, along with local taxes of up to 3.5%.

After covering the costs of running the state’s marijuana program, tax revenue is distributed as follows:

- 35% to the General Revenue Fund

- 25% to the Recover, Reinvest, and Renew (3R) Program

- 20% to mental health services and substance abuse programs

- 10% to pay unpaid bills

- 10% to the Local Government Distributive Fund, for prevention and training for law enforcement

- 2% to public education and safety campaigns