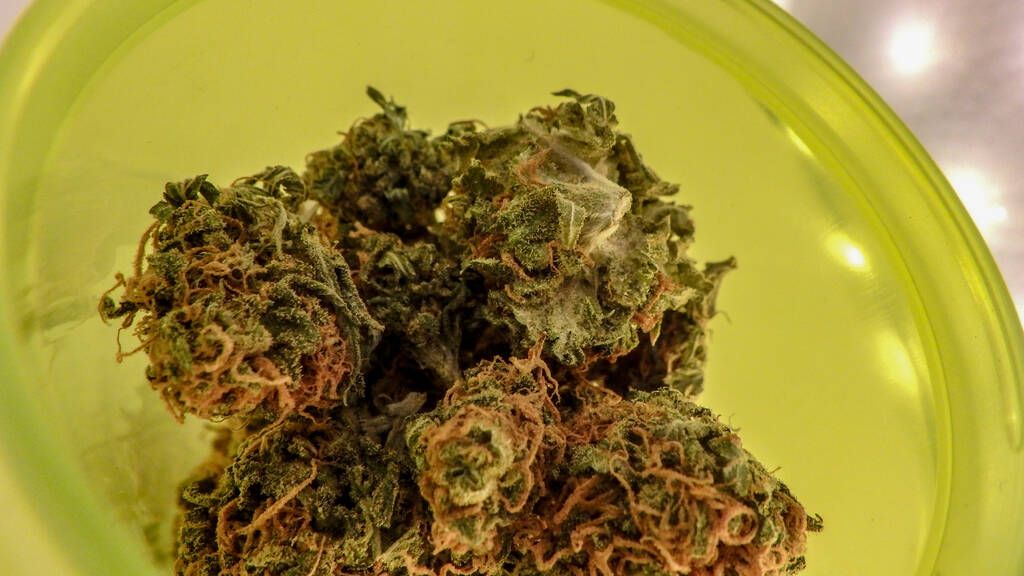

The University of Illinois Springfield (UIS) has partnered with Green Flower, a leading cannabis education provider, to launch five online certificate programs aimed at preparing individuals for careers in the rapidly expanding marijuana industry.

These programs, which span six months, are designed to be completed entirely online, allowing participants to balance their education with other commitments.

The available certificate programs include:

Continue reading