Baltimore voters will decide on November 5 whether to establish a city fund aimed at compensating communities disproportionately impacted by past cannabis arrests and prosecutions.

This charter amendment, known as Question G, would utilize state funds, which stem from Maryland’s recreational marijuana sales tax, to support these communities.

Maryland imposes a 9% tax on recreational cannabis, with 35% of the revenue directed to the state’s Community Repair and Reinvestment Fund. Baltimore is set to receive the largest share, as the city accounted for 30% of all marijuana possession prosecutions between July 1, 2002, and Jan. 1, 2023.

Continue reading

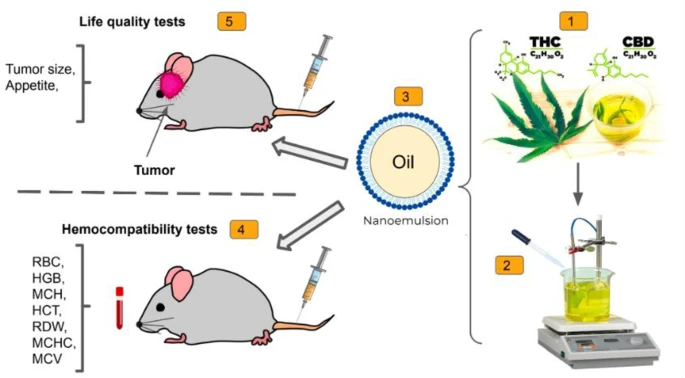

Researchers from the University of Medical Sciences, University of Tehran, and North Khorasan University of Medical Sciences in Iran have developed a nanoemulsion designed to boost the effectiveness of two key cannabis compounds, THC and CBD, in treating this aggressive form of brain cancer. The study demonstrated that this innovative delivery method significantly reduced tumor size and extended survival in animal models, potentially offering a new therapeutic avenue for glioblastoma.

Researchers from the University of Medical Sciences, University of Tehran, and North Khorasan University of Medical Sciences in Iran have developed a nanoemulsion designed to boost the effectiveness of two key cannabis compounds, THC and CBD, in treating this aggressive form of brain cancer. The study demonstrated that this innovative delivery method significantly reduced tumor size and extended survival in animal models, potentially offering a new therapeutic avenue for glioblastoma.