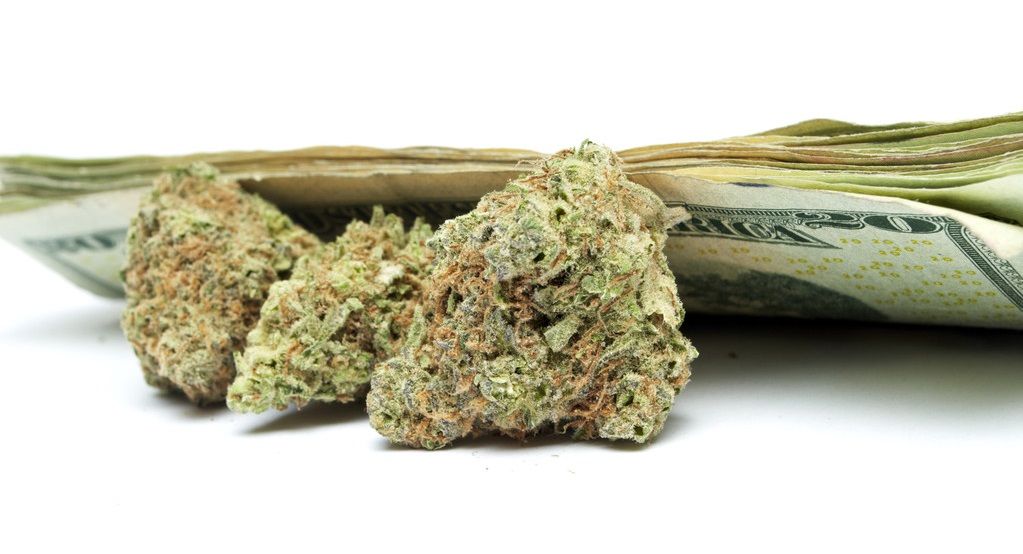

A bill in the US House of Representatives to allow marijuana banking now has 112 sponsors.

Yesterday Congressmembers Troy Carter (D-LA), Ann D Kuster (D-NH) and Schakowsky (D-IL) joined on as sponsors to the SAFE Banking Act, bringing the total number of sponsors to 112, with eight signing on this month alone.

Yesterday Congressmembers Troy Carter (D-LA), Ann D Kuster (D-NH) and Schakowsky (D-IL) joined on as sponsors to the SAFE Banking Act, bringing the total number of sponsors to 112, with eight signing on this month alone.

The SAFE Banking Act would explicitly allow banks and other financial institutions (credit unions, for example) that provide banking services to marijuana businesses that are legal under their state’s laws. This would allow banks to provide marijuana businesses with services such as debit and credit card processing and bank loans.

The full text of the SAFE Banking Act, filed in April, can be found by clicking here.

In the Senate, the updated SAFER Banking Act (filed in September) has 36 sponsors, representing 36% of the entire chamber. In September the SAFER Banking Act was passed through the Committee on Banking, Housing and Urban Affairs with bipartisan support. Earlier this month Senate Majority Leader Chuck Schumer said it’s a key priority of the Senate to pass the SAFER Banking Act this year.

According to polling released earlier this week, “by a greater than a 3-to-1 margin (63% support vs. 17% oppose) U.S. adults support Congress passing legislation that allows cannabis businesses to access banking services and financial products like checking accounts and business loans in states where cannabis is now legal”.

The SAFE and SAFER Banking Acts has the support of the National Conference of State Legislatures, as well as a bipartisan group of 22 attorneys general.

The SAFE Banking Act states:

With respect to providing a financial service to a State-sanctioned marijuana business (where such State-sanctioned marijuana business operates within a State, an Indian Tribe, or a political subdivision of a State that allows the cultivation, production, manufacture, sale, transportation, display, dispensing, distribution, or purchase of marijuana pursuant to a law or regulation of such State, Indian Tribe, or political subdivision, as applicable) or a service provider (wherever located), a depository institution, an entity performing a financial service for or in association with a depository institution, a community development financial institution, or an insurer that provides a financial service to a State-sanctioned marijuana business or service provider, and the officers, directors, employees, and agents of that depository institution, entity, community development financial institution, or insurer may not be held liable pursuant to any Federal law or regulation—

(1) solely for providing such a financial service; or

(2)for further investing any income derived from such a financial service.

The measure also states:

For the purposes of sections 1956 and 1957 of title 18, United States Code, and all other provisions of Federal law, the proceeds from marijuana-related activities of a State-sanctioned marijuana business or service provider that conducts all of its marijuana-related activity in compliance with the marijuana-related law of the State, Indian Tribe, or political subdivision of the State shall not be considered proceeds from an unlawful activity solely because—

(1) the transaction involves proceeds from a State-sanctioned marijuana business or service provider; or

(2) the transaction involves proceeds from—

(A) marijuana-related activities described in section 2(19)(B) conducted by a State-sanctioned marijuana business; or

(B) activities described in section 2(17)(A) conducted by a service provider.

The measure also provides protections for insurers, stating:

With respect to engaging in the business of insurance within a State, an Indian Tribe, or a political subdivision of a State that allows the cultivation, production, manufacture, sale, transportation, display, dispensing, distribution, or purchase of marijuana pursuant to a law or regulation of such State, Indian Tribe, or political subdivision, as applicable, an insurer that engages in the business of insurance with a State-sanctioned marijuana business or service provider or that otherwise engages with a person in a transaction permissible pursuant to a law (including regulations) of such State, Indian Tribe, or political subdivision related to marijuana, and the officers, directors, and employees of that insurer, may not be held liable pursuant to any Federal law or regulation—

(1)solely for engaging in the business of insurance; or

(2)for further investing any income derived from the business of insurance.